The Compliance Definition in Business Simplified

So, what does “business compliance” actually mean?

At its simplest, business compliance is about your company following the rules—all of them. This means adhering to every applicable law, regulation, industry standard, and even your own internal ethical guidelines. Think of it as the official playbook for running your business responsibly and legally.

What Is Business Compliance Really

Let's look past the textbook definition. At its heart, business compliance is the framework that dictates how your company behaves. It’s a lot like traffic laws preventing chaos on the roads; compliance rules bring order to the marketplace, protecting consumers, employees, and your business from unnecessary risks.

This isn’t just a task for the legal department—it’s a core business function. It covers everything from workplace safety standards and customer data privacy laws to your own internal codes of conduct. Simply put, it's your commitment to playing by the rules.

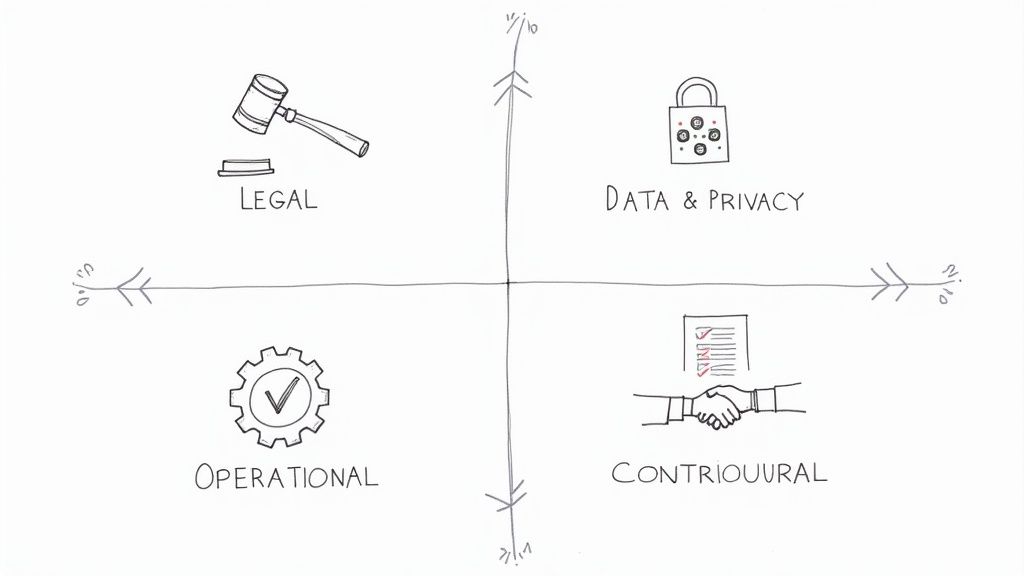

To get a clearer picture, let's break down the main areas compliance touches.

Table: Core Pillars of Business Compliance

| Pillar | What It Means for Your Business |

|---|---|

| Legal | Following federal, state, and local laws. This is non-negotiable. |

| Regulatory | Adhering to rules set by governing bodies (e.g., OSHA, FTC). |

| Data & Privacy | Protecting sensitive information according to laws like GDPR or CCPA. |

| Operational | Following internal policies and procedures for consistent, safe operations. |

| Contractual | Honoring the terms agreed upon with clients, vendors, and partners. |

Each pillar represents a different set of rules, but they all work together to keep your business on solid ground.

The Evolving Demands of Compliance

Staying compliant isn't a one-and-done task. The goalposts are always moving as new regulations pop up. This complexity is a real hurdle; recent data reveals that 85% of compliance professionals find regulatory requirements are getting more complicated.

This isn't just an administrative headache, either. The same report showed that 82% of businesses admit these growing demands slow down their ability to launch important projects. The takeaway here is clear: you can’t afford to ignore compliance if you want to grow. You can dig deeper into these compliance statistics and their business impact.

Compliance is the structural integrity of your business. Without it, even the most innovative company risks collapse from legal challenges, financial penalties, or a loss of public trust. It’s the foundation upon which sustainable growth is built.

When you get it right, a strong compliance culture stops being a burden and becomes a real asset. It safeguards your reputation, builds customer loyalty, and creates a stable, ethical environment where your team can do their best work.

The Main Flavors of Business Compliance

To really get a handle on compliance, you can't just think of it as one giant, intimidating blob of rules. It’s much more manageable when you break it down into distinct categories. Each one covers a different part of your business, and understanding them is the first step toward managing your agency's risk effectively.

Think of them as different chapters in your company's rulebook. They all contribute to the same story—running a responsible, sustainable business—but each has its own unique plot and consequences.

Legal and Regulatory Compliance

This is the big one. It’s the baseline—the official laws and regulations handed down by governments. These are the non-negotiable rules of the game that everyone has to play by, from local city ordinances all the way up to federal laws. This framework is what ensures fair competition, keeps workers safe, and protects the environment.

Following these rules isn't a choice. For instance, the Occupational Safety and Health Administration (OSHA) sets mandatory standards for workplace safety, while the Environmental Protection Agency (EPA) has strict rules about pollution. Ignore them, and you're looking at serious legal and financial trouble.

A classic example for marketing agencies is the CAN-SPAM Act, which dictates how you can (and can't) use commercial email.

The CAN-SPAM Act lays out clear rules for commercial messages, gives people the right to opt-out, and carries some heavy penalties. Every single email that violates the act can be hit with a fine of up to $53,088. It doesn't take long for that to add up.

This really drives home how a basic marketing task is wrapped in legally-binding regulations with expensive consequences.

Data and Privacy Compliance

This area has absolutely exploded in importance over the last decade. Data and privacy compliance is all about how your agency collects, stores, uses, and protects personal information. With cyberattacks becoming more common and people growing more concerned about their privacy, governments have stepped in with some powerful laws to protect consumer data.

You’ve probably heard of the big ones:

- General Data Protection Regulation (GDPR): This EU law has become the gold standard for data protection worldwide. If you handle data from anyone in the EU, GDPR applies to you.

- California Consumer Privacy Act (CCPA): This law gives California residents much more control over the personal information that businesses gather about them.

For an agency, this is critical. You're handling client lists, customer analytics, and all sorts of sensitive data. A slip-up here doesn't just mean massive fines; it can completely shatter the trust you've built with your clients.

Operational and Contractual Compliance

Finally, we have the rules you set for yourself and the promises you make to others. It’s about walking the talk.

Operational compliance is about following your own internal playbook. These are the policies, procedures, and workflows you’ve created to ensure consistency and quality. We're talking about your standard operating procedures (SOPs), employee handbooks, and internal codes of conduct. They're the rails that keep your agency running smoothly.

Contractual compliance, on the other hand, is simply about keeping your promises. When you sign a contract with a client, vendor, or partner, you are legally obligated to deliver what you agreed to. That means hitting deadlines, staying within scope, and honoring confidentiality clauses. Dropping the ball here can lead to lawsuits, torched relationships, and a reputation for being an agency that can't be trusted.

How Compliance Becomes a Strategic Advantage

It’s easy to think of compliance as just another box to check—a tedious, defensive chore. But that’s a huge, costly mistake. The smartest agencies flip this thinking on its head. They see compliance not as a cost center, but as a powerful offensive tool that carves out a real competitive edge.

This isn’t just a minor shift in perspective; it’s a fundamental change in how you operate. When doing things the right way is baked into your company’s DNA, you stop just avoiding fines. You start building a more resilient, reputable, and profitable business from the ground up.

Building an Ironclad Brand Reputation

In a world where one misstep can go viral, your reputation is everything. A solid, transparent compliance program is one of the best ways to guard that reputation fiercely. When you consistently meet—and even exceed—regulatory standards, you send a powerful signal to clients and partners. The message is clear: we are professionals you can count on.

This proactive approach builds a kind of protective armor around your brand. When a new regulation throws your industry into chaos or a competitor gets caught cutting corners, you stand out as the stable, ethical choice. This reputation for integrity becomes a magnet for higher-value clients who would rather pay for peace of mind than risk working with someone less diligent.

A robust compliance framework isn't just about risk mitigation; it's a marketing asset. It tells a compelling story of accountability and trust that resonates deeply with today's discerning customers, making it a cornerstone of brand loyalty.

Ultimately, a commitment to doing things by the book pays off in the long run, cementing a positive public image that's hard to tarnish.

Fostering Deeper Customer and Client Trust

For agencies, trust isn't just a nice-to-have; it's the currency you trade in. You're handling sensitive client data, managing critical projects, and acting as a steward of their brand. Every single part of your compliance program, from your data privacy policies to your clear-cut contracts, is a deposit into that bank of trust.

When clients see you're serious about regulations like GDPR or the CCPA, they feel safe giving you their data. That confidence is gold. It leads to stronger relationships, better client retention, and a much smoother path to upselling or expanding your work with them. It eliminates a huge piece of friction in the sales process because you’re showing, not just telling, them that their business is safe in your hands.

Think about two agencies pitching for a big contract:

- Agency A says they "take privacy seriously" but offers no details.

- Agency B walks the client through their documented compliance program, showing exactly how they handle data and the security measures in place.

Agency B almost always wins. That concrete proof of diligence builds an immediate foundation of trust that Agency A simply can't compete with. It's often the single deciding factor that lands you the best clients and turns them into long-term partners.

The Real-World Consequences of Non-Compliance

Ignoring compliance is a bit like driving without insurance. For a while, you might save a little money and feel like you’re getting ahead. But when an accident happens—and it eventually does—the consequences are sudden, severe, and can wipe out everything you’ve worked so hard to build.

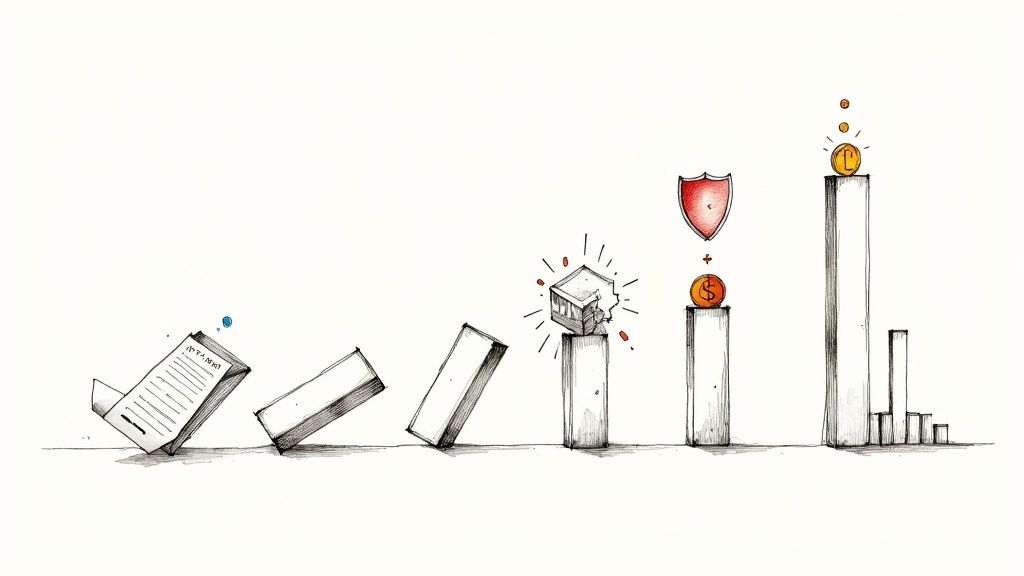

The fallout from a compliance failure isn't just a simple slap on the wrist. Think of it more as a cascade of damage that hits your business from every possible angle, starting with the most obvious pain point: staggering financial penalties.

These aren't minor fines we're talking about; they can be absolutely crippling. A single email that violates the CAN-SPAM Act, for example, can result in a penalty of up to $53,088. Now, imagine the potential cost of an entire marketing campaign that gets it wrong. It's the same story with data privacy laws like GDPR, where mishandling data can trigger fines that easily run into the millions.

The Financial Drain of Penalties

The most direct and painful impact of ignoring the compliance definition in business is the hit to your bottom line. Regulatory bodies don't mess around, and the penalties are designed to be a powerful deterrent. With the global spread of data protection laws, this threat is now universal.

The enforcement of data protection laws, like the European Union’s GDPR, resulted in €1.2 billion in fines in a single recent year. And with 144 countries now having similar laws that cover over 79% of the world’s population, no business is truly immune. If you're curious about these trends, you can explore more insights on global data protection enforcement trends on Zluri.com.

A compliance failure is never just one event. It’s the start of a domino effect: the fine is the first piece to fall, followed swiftly by legal fees, reputational damage, and lost customer trust. The total cost is always far greater than the initial penalty.

Beyond the initial fine, the financial bleeding continues. Legal battles are notoriously expensive and time-consuming, pulling precious resources away from what they should be focused on—growing your agency.

Operational Shutdowns and Lost Opportunities

The consequences cut deep into your day-to-day operations, too. A serious compliance breach can lead to a complete operational shutdown, either ordered by regulators or because your systems have been fundamentally compromised. Every minute you're offline is lost revenue.

Think about a tech startup that misuses customer data. They could lose their biggest client overnight, not just because of the breach itself, but because the trust is gone. That single event can set off a chain reaction, scaring away potential new clients and partners who now see the business as too high-risk. Future growth opportunities simply evaporate as your reputation sours.

Consider these all-too-common scenarios:

- Losing Certifications: Violating industry standards could mean losing essential certifications (like ISO 27001), instantly making you ineligible for valuable government or enterprise contracts.

- Business Interruption: A major safety violation could halt operations entirely while you're forced to overhaul processes, costing you weeks or even months of productivity.

- Criminal Charges: In the most severe cases of negligence, like major environmental or financial fraud, executives can even face criminal charges and jail time.

When you look at it this way, the price of proactive compliance is a small investment. The cost of failure, on the other hand, is a debt that many businesses can never repay.

How to Build an Effective Compliance Program

Alright, so you understand what compliance is. Now comes the important part: actually building a framework that protects your agency. This isn't about creating a massive, dusty rulebook that no one ever reads. It’s about weaving a living, breathing system into the very fabric of your daily work.

Think of a good compliance program as a roadmap, not a roadblock. It gives your team clear directions, keeps your work consistent, and shows everyone—clients included—that you’re serious about doing things the right way. Getting this foundation in place takes a structured approach, and it all starts with taking an honest look at where you might be vulnerable.

Conduct a Thorough Risk Assessment

You can't defend against threats you haven't identified. The very first step is a risk assessment to pinpoint where your agency's weak spots are. This means mapping out every part of your operation to find potential compliance gaps before they become real problems.

So, what does that actually involve? It's about asking some tough but necessary questions:

- Where and how are we handling sensitive data from clients or their customers?

- What specific industry rules, like advertising standards or financial regulations, apply to the services we offer?

- What are the non-negotiable terms in our most important client contracts?

- Are our internal HR policies current with the latest labor laws?

Answering these questions gives you a clear picture of your agency's unique risk profile. This lets you focus your energy on the biggest threats first, rather than trying to boil the ocean.

Develop and Document Clear Policies

Once you know where the risks are, you need to create straightforward, written policies to manage them. These documents form the backbone of your program, turning complicated regulations into simple, actionable steps your team can actually use. Ditch the legal jargon and write in plain, simple English.

Your core policies should cover the big things, like your code of conduct, data handling procedures, and standards for client communication. Having this documentation creates a single source of truth, cutting down on confusion and making sure everyone is on the same page.

An undocumented process is just a suggestion. A documented policy is a commitment. Clear, written guidelines transform good intentions into reliable, repeatable actions that fortify your entire business operation against compliance failures.

Implement Ongoing Training and Education

A brilliant compliance plan is completely worthless if your team doesn't know it exists or, worse, doesn't understand it. That’s why ongoing training is non-negotiable. It’s how you build a real culture of compliance where every single person knows the role they play in protecting the agency.

And please, don't make this a one-and-done lecture during onboarding. Real, effective training is continuous. It should be engaging and use real-world examples that connect directly to your team's day-to-day work. For instance, walk your marketing team through exactly how to apply CAN-SPAM rules to their next email campaign. Constant reinforcement is what keeps compliance from becoming an afterthought.

The investment here is real. The Compliance Data Management market is on track to hit $16.6 billion, and there’s a good reason for it. Businesses are pouring money into this because it works. For example, using automated tools to track regulations has been shown to cut down policy-related delays by a whopping 50%. You can dig deeper into these numbers with these CCO statistics on Complianceandrisks.com. It just goes to show how much value there is in backing up your program with the right tech and training.

With your program in place, it’s time to put it into action. The following checklist breaks down the implementation process into manageable phases, helping you move from planning to a fully functional compliance framework.

Compliance Program Implementation Checklist

| Phase | Key Action Items | Success Indicator |

|---|---|---|

| Phase 1: Foundation & Assessment | 1. Secure leadership buy-in and assign a compliance lead. 2. Conduct a comprehensive risk assessment across all departments. 3. Identify all applicable laws, regulations, and contractual obligations. |

Leadership is actively championing the program, and a detailed risk report is completed. |

| Phase 2: Policy Development | 1. Draft clear, accessible policies (Code of Conduct, Data Privacy, etc.). 2. Create procedures for reporting potential violations. 3. Get legal review for all drafted policies. |

A central, employee-accessible repository of all final policies is established. |

| Phase 3: Implementation & Training | 1. Roll out an initial all-hands training session on the new program. 2. Develop role-specific training modules for high-risk teams. 3. Integrate compliance checks into existing workflows (e.g., project kickoffs). |

At least 95% of employees have completed initial training with documented comprehension. |

| Phase 4: Monitoring & Response | 1. Schedule regular internal audits (e.g., quarterly or bi-annually). 2. Establish a clear protocol for investigating and responding to incidents. 3. Implement a system for tracking regulatory changes. |

A documented incident response has been tested, and a monitoring schedule is in place. |

This checklist isn't just a to-do list; it's a roadmap to building a resilient program. The final, critical piece is establishing a system to monitor how well everyone is sticking to the plan and having a clear response strategy for when things inevitably go wrong. Regular audits and a clear-cut protocol for handling incidents are what will keep your program sharp and effective over the long haul.

Your Essential Business Compliance Questions Answered

Diving into business compliance can feel like trying to read a map in a foreign language, especially when you’re building a program from scratch. It's totally normal to have questions. This section cuts through the noise to give you straight, clear answers to the most common things we hear from business leaders.

Think of it as your field guide for turning uncertainty into confident action. We’ll get into the practical first steps for smaller businesses, how often you should dust off those policy documents, and the all-important difference between following the rules and just doing the right thing.

As a Small Business, Where Do I Start?

If you're running a small business, the very idea of a "compliance program" can sound intimidating and expensive. The secret is to forget about boiling the ocean. Start small and aim your efforts at your biggest areas of risk first.

You don’t need to tackle everything at once. Instead, focus on two foundational areas that affect almost every business, no matter the size:

- Employee Safety: This is non-negotiable. Make sure you meet all the basic workplace safety standards required by law. It’s about protecting your people, which in turn protects your business from serious liability.

- Data Privacy: This one trips up a lot of companies. Start by creating a simple "data map." Figure out exactly what customer information you collect, where it lives, and who can access it. This simple exercise is the bedrock of protecting sensitive data.

By zeroing in on these two high-impact areas, you lay a solid foundation that you can build on as your business grows. This approach makes business compliance a manageable part of your operations, not some scary, abstract concept.

This simple workflow is a great way to visualize the process.

It really is that straightforward. You assess your risks, develop clear policies to manage them, and then train your team so everyone is on the same page.

How Often Should We Review Our Policies?

Compliance isn't a crockpot meal you can set and forget. The world of business is always in motion—new laws get passed, regulations change, and industry standards evolve. If your policies stay static, they become obsolete.

A good rule of thumb is to give all your compliance policies a thorough review at least once a year. That said, some events should trigger an immediate look under the hood, like:

- A major new law that impacts your industry is passed.

- You launch a new product, service, or business division.

- You make a big operational shift, like expanding into a new country.

- You have a compliance failure or even a close call.

Think of your compliance policies like your car's maintenance schedule. The annual oil change is essential, but if the check engine light comes on, you pull over immediately. Regular reviews keep your business running smoothly and prevent a total breakdown.

What Is the Difference Between Compliance and Ethics?

This is a fantastic question, and getting the distinction right is crucial. While they're closely related and work hand-in-hand, compliance and ethics are not the same thing. Knowing the difference is what separates a good company from a great one.

Compliance is about following the rules. It’s the mandatory stuff—the laws, regulations, and standards you must adhere to. It answers the question, "What do we have to do?" Failure to comply comes with real-world penalties like fines or legal action.

Ethics is about doing what’s right. It’s driven by your company's internal moral compass and core values, especially in situations where there isn’t a specific law to guide you. It answers the question, "What should we do?"

For instance, a marketing campaign could be perfectly legal and tick every compliance box, but still be unethical if it preys on vulnerable customers. A truly resilient business needs both. Compliance sets the floor for acceptable behavior, while ethics raises the ceiling, guiding you to build trust and operate with integrity.

At RGK, we've built an operating system designed to give agencies the structure they need to scale responsibly. By bringing your project management, client data, and internal processes into one place, RGK helps you weave compliance checks directly into your day-to-day work, so your team can grow without the chaos. Find out how you can build a more resilient agency.